The financial sector has largely been a traditionally operating one, preferring to work within its tried-and-tested methodologies and dependencies. However the rise of AI over the last few years has slowly brought about change in the financial sector as well. A report from Nvidia suggests over 75% of surveyed organizations believe that AI and LLMs (Large Language Model) are an integral part of their workflow. AI in finance is here to stay now, and with it, several trends emerge, regarding its usage and predictability.

In this article, we’d like to talk about some of these trends that AI has been shaping in the finance sector and how you can use AI to create a unified customer experience for your finance venture.

Streamlining Operations with Automation

One of the most impactful applications of AI in finance is automation. Repetitive tasks that were once handled by human employees are now being efficiently managed by AI-powered systems. Loan processing, for instance, is a prime example. Traditionally, loan applications involved manual verification of documents, credit checks, and risk assessments. AI algorithms can now automate these processes, significantly reducing processing time and error rates. Such an advancement now frees up valuable employee resources to focus on tasks such as building client relationships and providing personalized financial advice to those who opt for it.

Take, for example, lending giant UpStart: The firm used automation to improve their CX for customers that applied for loans. This led to an 89% increase in loan applications and approvals solely through an automated process.

Revolutionizing Customer Experience

The way customers interact with financial institutions is also evolving rapidly. AI-powered chatbots are creating a unified customer experience. These virtual assistants can answer questions about customer accounts, help process transactions, and also provide basic financial guidance if there is a knowledge bank built in. The 24/7 availability of such customer service enhances convenience and leads to more satisfaction. NLP is also being used to analyze customer data and identify patterns that can be adapted to personalize financial products and services. By analyzing vast amounts of this data, NLP can identify spending habits, investment goals, and risk tolerances. According to the Consumer Financial Protection Bureau, nearly 37% of the American population interacted with a chatbot in 2022, and companies saved over 60 cents per interaction with an AI chatbot.

Enhancing Risk Management through Data Analysis

Financial institutions have always grappled with managing risk. AI offers a powerful toolset for this challenge. AI algorithms can analyze vast datasets, including financial transactions, market trends, and customer behavior, to identify patterns and predict potential risks. There are reports of companies using AI to reduce risk by over 23% in the last year alone, which is a significant endorsement for AI in finance.

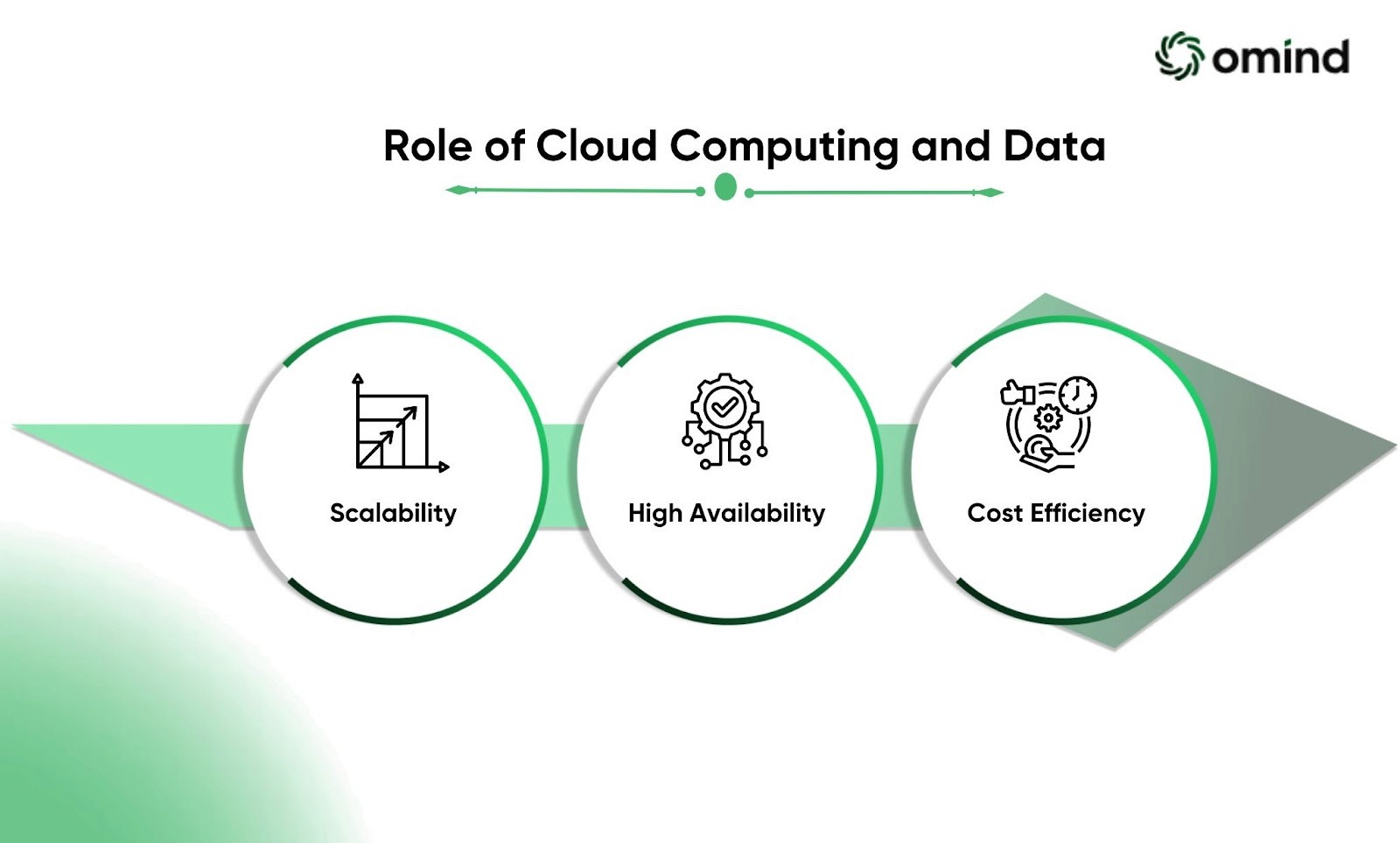

The Role of Cloud Computing and Data

The integration of AI into the financial sector wouldn't be possible without the robust foundation provided by cloud computing and data. Cloud platforms act as the digital powerhouse for AI, offering the essential infrastructure for storing, processing and analyzing the massive datasets that fuel models for AI in finance.

Financial institutions generate a staggering amount of data – from transaction histories and investment records to customer demographics and market trends. However, traditional on-premise IT systems often struggle to handle the sheer volume and complexity of this information. A McKinsey report suggests that only 13% of finance companies actually used the cloud for their workflow, but over 54% were looking to switch to cloud computing soon.

Cloud computing offers a scalable and cost-effective solution. Here's how:

Scalability: Cloud platforms offer on-demand storage and processing power. Financial institutions can easily scale their infrastructure up or down based on their evolving AI needs. This eliminates the need for expensive upfront investments in hardware and software, allowing institutions to be more flexible and agile.

High Availability: Cloud providers ensure high availability of data and computing resources. This means minimal downtime and disruptions, which is crucial for ensuring the smooth operation of AI models. Financial transactions can't afford to wait for a server reboot.

Cost Efficiency: Cloud computing eliminates the need for expensive hardware maintenance and upgrades. Financial institutions only pay for the resources they use, which translates to significant cost savings. This frees up resources that can be reinvested into further AI development and innovation.

AI Augmenting Fraud Detection

Financial institutions are leveraging AI's prowess in anomaly detection to combat fraud. AI algorithms can analyze vast amounts of transaction data in real-time, identifying patterns and deviations from a customer's typical spending habits. This allows for immediate intervention and potential fraud prevention. A study by Juniper Research found that AI-powered fraud detection solutions are expected to save a significant sum of money for financial institutions globally, between 2024 and 2029, highlighting the significant impact of AI in safeguarding the finance industry.

The Power Of AI In Investments

In the world of investment management, AI is assisting portfolio managers in dealing with a market that is constantly in flux. Algorithms can analyze vast datasets, incorporating historical market trends, company financials, news sentiment, and even social media data to identify undervalued assets and generate potentially alpha-rich investment opportunities. Finance managers can now make data-driven decisions and also free themselves from the time-consuming task of manually sifting through mountains of information. According to a PwC report, 90% of asset managers believe AI will significantly improve their investment decision-making capabilities, underscoring the transformative potential of AI in the investment world.

Regulatory Considerations and the Path Forward

As AI continues to permeate the financial sector, regulatory bodies are closely scrutinizing its implementation, while also exploring the use-cases of AI themselves. The United States Consumer Finance Protection Bureau recently released guidelines around AI in finance, as an example of the good that AI can do for organizations and communities.

Concerns around fairness, transparency, and data privacy are paramount. Regulatory frameworks must be developed to ensure responsible use of AI in finance while encouraging innovation. Open communication and collaboration between financial institutions, technology companies, and regulatory bodies will be essential for providing context for this evolving field.

AI: The Future of Finance

The integration of AI into the financial sector is still in its early stages, but the potential for transformation is undeniable. AI is poised to streamline operations, enhance customer experience, and improve risk management. As AI technology continues to evolve and regulatory frameworks adapt, we can expect even more innovative applications to emerge in the years to come. The future of finance is one driven by data, intelligence, and a collaborative approach between humans and machines.

If you’re part of a finance organization and want to create a unified customer experience, and also help your internal teams, Omind harnesses AI with our conversational platform that helps visitors engage with your business and turns visitors into paying customers, along with employee experience and workplace experience solutions as well. To see how our platform works, schedule a demo today.

AUTHOR

Team Omind

Empowering Businesses with Unified Customer Experience Platform, Leveraging Advanced AI and Intelligent Automation

PRODUCT

AI

Share LINK

Related Blogs